Online Loan Apps Fraud: DO Not fall Into the TRAP

In India, incidents of cybercrime related to online loan App fraud are increasing at an alarming rate. Many victims are turning to suicide since they are unable to repay the loan amount because of the outrageous interest rates and ongoing harassment from debt recovery agents.

The Indian government has been working toward banning these fraudulent loan apps from the Google Play Store and then the App Store but hasn’t been successful.

Awareness among the general public needs to be raised to stop people from becoming victims of these fraudulent apps.

What are fraud loan apps?

Unlike traditional loan apps, which are operated by banks and other financial institutions, fraud loan apps are simply applications uploaded by scammers on the play store that offer loan amounts ranging from 1000 to 10,000 rupees, primarily to low-wage individuals in need of funds.

These loan apps don’t require much documentation. With basic information like your Aadhar number, mobile number, and some verification, your loan will be credited to your account.

You will be happy when the money arrives in your account, but the happiness will not last long.

When you consider the processing fee and the interest rate, the amount is greater than what you received from the loan application.

That’s when the harassment starts.

How do fraudulent loan apps operate?

These fraudulent loan apps operate by reaching out to people through phone calls and messages, offering details about the instant loan and a link to the app attached to it.

People fall victim to getting instant money and doing what the scammer says.

Once the victim downloads the application, it asks for permission to access the contacts, media files, and many unnecessary permissions to activate the app.

That’s where the loan app collects the data from your phone to harass you later on.

The app then moves on to verification of the person by asking for phone numbers and identity details.

It asks for your Aadhar card and your photo to continue the registration process.

Once the registration process is successful, the loan app instantly credits money to your account.

The borrower’s expectations are exceeded by the repayment amount, which also includes processing fees, taxes, and interest, leaving him helpless.

When he fails to repay the amount, the loan app agents harass him by calling his contacts and messaging them on WhatsApp regarding the loan money.

The blackmail doesn’t stop here.

Even if somehow he pays them the amount, in some cases the loan apps again credit money in his account and extort him to pay double the amount.

To get the money back from him if he doesn’t pay, they turn his photos into explicit content and share them with his WhatsApp contacts.

Some people can complain about such incidents with proper guidance and those who don’t have enough confidence suffer in silence and take life-threatening actions.

Read – Predatory loan apps in India rake in huge fees, and are driving some users to suicide

Fake loan app harassment complaints?

If you ever become a victim of a loan app fraud, immediately contact your nearest cyber cell or call the cyber crime helpline numbers in your area.

If you still can’t reach them, you can file an online cyber complaint at the National Cyber Crime Reporting Portal, established by the government of India for the resolution of cases related to cybercrime and financial fraud.

You can also call 1930, the national cybercrime helpline number, to report your problem about fake loan app harassment complaint.

How to stop loan apps from accessing my contacts?

If you downloaded a fraud loan app by accident you can deny them access to your contacts by going to App settings > Permissions and revoking their access to your contact list, storage, and media files and messages.

Now they won’t be able to access your contacts and files. They will only have the contact number by which you registered.

Let’s examine how apps access the data on your phones.

Any app you download from the Google Play Store will prompt you for permission to use the phone’s software after installation before you can use it. This is done for the app’s assessability.

For the app to function, only the necessary permissions must be granted.

For instance, if you download a map app, you should only permit it to access your phone’s GPS.

In the same way, you shouldn’t give an app permission to access your phone’s media gallery or contact list if you want to prevent apps from accessing unnecessary data.

Do not grant unnecessary permissions while installing apps from unknown sources.

To prevent Loan apps from accessing your contact you should not grant them permission to access your contact list and media gallery while installing the app.

Once you grant permission to the loan app it cants be reverted and you will not be able to delete your information from the app database.

Can The loan apps access my contact if uninstalled?

No, after uninstalling the app, it cannot access the contact list but keep in mind that during the installation of the app if you granted permission to the app to access your contacts it might still have your contacts even after deleting the app from your phone.

Even after you uninstall the Loan app, the permissions you gave it to access your contacts and media gallery during installation are irreversible.

Your contact is stored in their database as soon as you permit them, and the user cannot remove it.

The best way to prevent them from receiving a contact list is to deny them access to it.

What happens if I don’t repay a loan taken from the Fraud loan apps?

When you are unable to repay the loan repayment amount, the loan apps agent begins blackmailing the borrower to return the money and threatens them by calling and informing their contacts about the incident.

This doesn’t stop here, they even start to message your WhatsApp contacts about the loan and tell them to inform you and pay the money.

I am aware of what two of my friends went through after falling victim to these fraudulent loan applications.

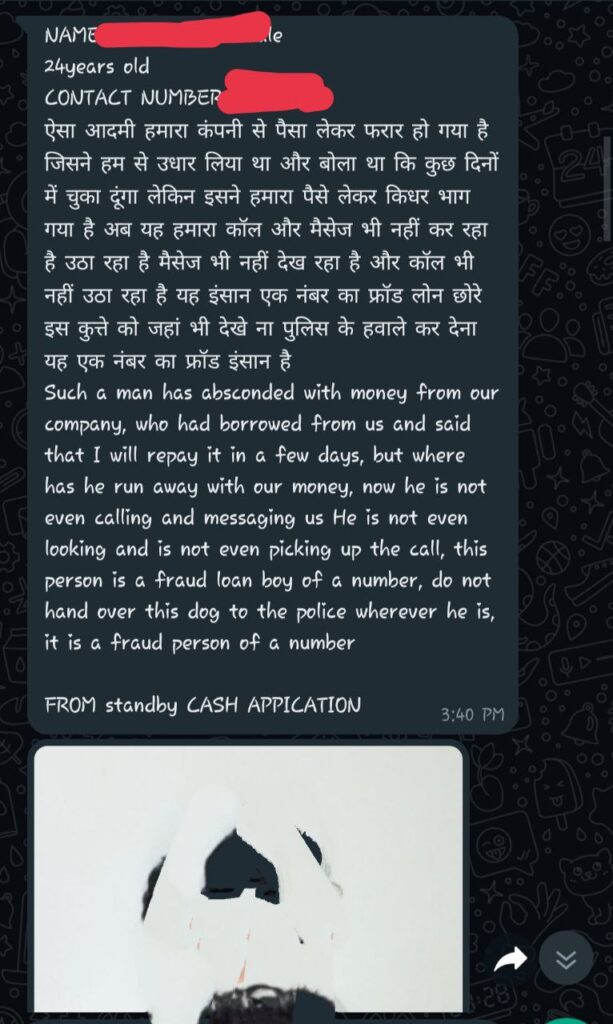

Let me share a message I received on WhatsApp from these fraudsters.

This is the kind of message they send to the WhatsApp contacts of the person who took the loan.

They even mention a photo of the borrower with the message.

How do I stop fraud loan app agents from calling my contacts?

Once they have your contact list they will call your contacts and harass you and them to get the money from you.

If they call your contacts, you should file an FIR in your nearest police station about the online loan app fraud and mention the numbers by whom you are receiving harassment calls.

Report the incident to the nearest cyber cell or national helpline 1903 to stop loan app agents from calling your contacts.

Also, file an online cybercrime complaint at the national cybercrime reporting portal.

The loan app agents mainly call on WhatsApp, they don’t use traditional calling to escape tracking.

Government action on the loan app fraud saga?

Recently finance minister Nirmala Sivaraman has asked to the RBI to only allow permitted apps to be available on the play store.

Before that google has removes more than 2000 loan apps from the play store targeting Indian users.

Saikat Mitra, Senior Director and Head of Trust and Safety at Google Asia-Pacific revealed that the blocked apps were directed at Indian users.

The tech juggernaut will implement additional changes to its Play Store policy, according to Mitra, to stop the spread of such predatory apps.

Google has started requiring personal loan applications in India to meet the new eligibility proof requirements.

The Reserve Bank of India (RBI) license copy and a statement that they are not directly engaged in money lending activities and are only offering a platform to enable registered non-banking financial companies (NBFCs) or banks to lend money to users are requirements for eligibility.

So the government is working to stop it but we the people should invest in empowering ourselves with the right knowledge about the internet world and be aware of the consequences easy money brings.

अगर आप साइबर क्राइम का शिकार हुए हे तो तुरंत साइबर क्राइम हेल्पलाइन या ऑनलाइन पोर्टल पर शिकायत दर्ज करे।

Related links-

- ED raid on loan apps reveals strong Chinese presence in crypto crimes

- How Chinese loan app fraud led to the tragic murder-suicide of Madhya Pradesh family

- Scam loan apps extorting Mexicans thrive in Google Play Stor

- Nirmala Sitharaman orders to crack whip on illegal loan apps

- Loan app fraud busted, four held for extorting many using bogus call centre

3 Comments